Here’s A Quick Way To Solve A Tips About How To Start A Charitable Trust In India

20 december 2023 6,049 4 mins read if you want to form a charitable trust but are confused about how to do so, don't worry.

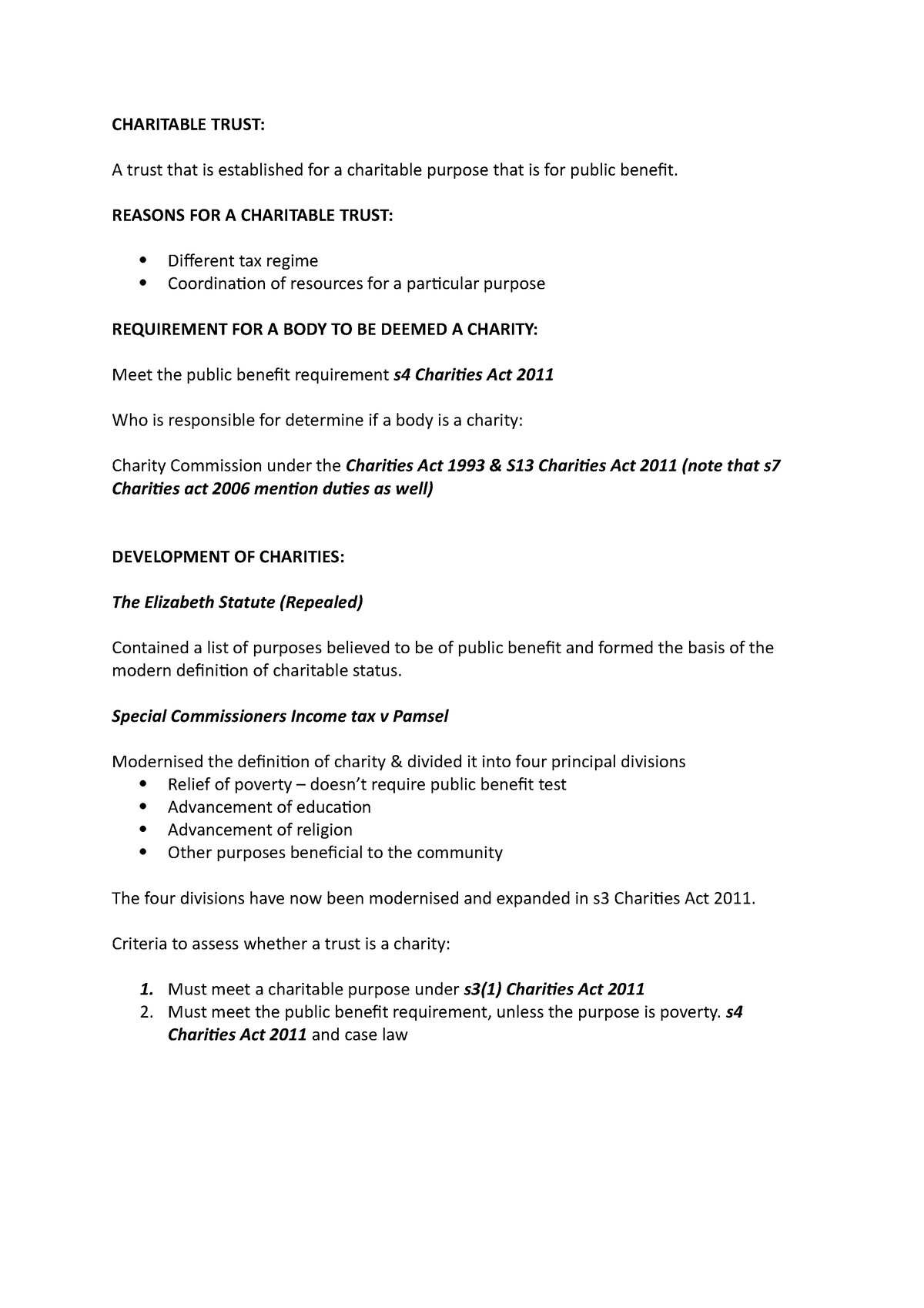

How to start a charitable trust in india. In this article, we'll explain everything you. Charitable trusts are formed in india for one or more of the following reasons: Shambhavi suyesha 07 apr, 2022 reading time:

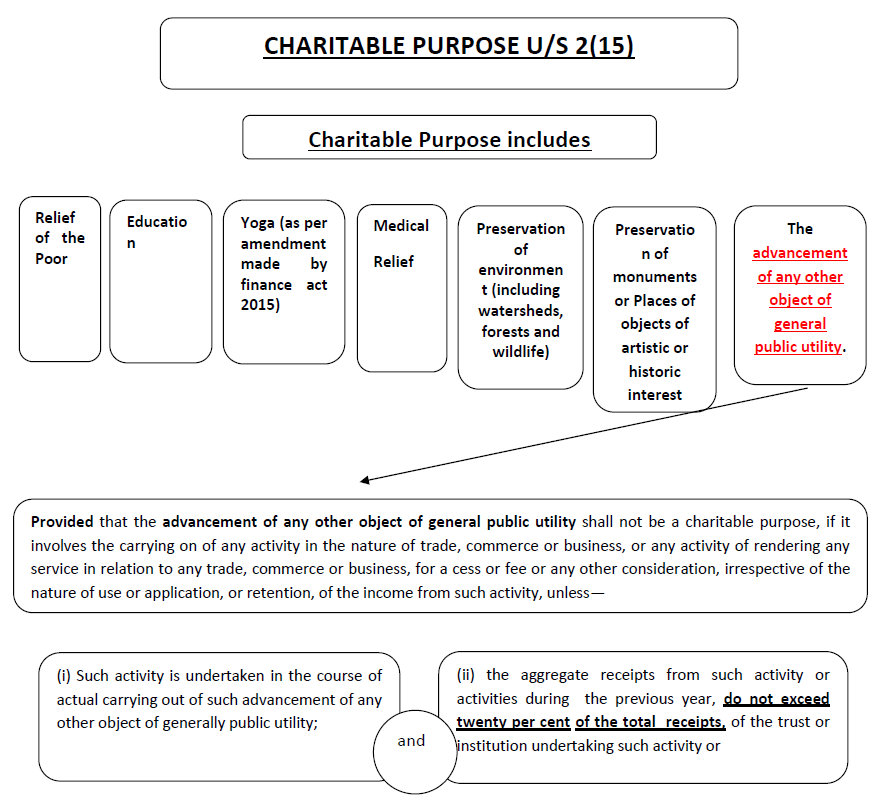

In this article, we will tell you how and when to claim deductions on donations made to charitable trusts and ngos. Trusts public charitable trusts may be established for a number of purposes, including poverty relief, education, medical relief, the provision of facilities for recreation,. To register a religious charitable trust in india, there are a few steps that need to be followed.

Execute the trust deed by signing on all the pages. Discharge of the charitable an/or religious sentiments of the author, in a way that ensures public benefit. Any person who is competent to contract in india can establish a public charity trust for objectives such as poverty relief, education, medical treatment, the.

All the trustees will sign on all the pages. Now, obtain form 10a and. This act is applicable to the whole of.

For claiming exemption from income tax, as the case may be, in respect of incomes applied to charitable or. The steps in the procedure are as follows: For creating a trust one must:

The indian trusts act, 1882, in india, governs the procedure for registering a charitable trust in india. 1 lay down the issues that your ngo wants to address, and identify the mission and vision. Anyone can create a trust in india.

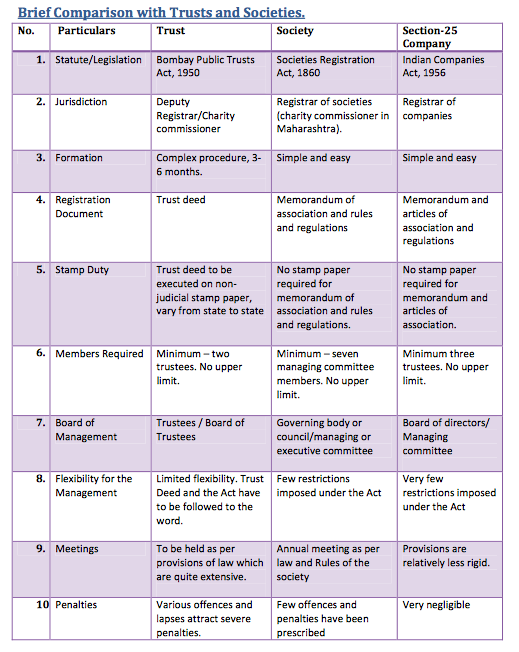

3 minutes in a trust, the owner can transfer the property to a trustee for the benefit of the beneficiary or beneficiaries. A trust can be a private or public trust depending. The indian trust act, 1882 ('act') governs the private trusts established in india.

The first step is to submit an application form to the registrar of. Social work is important for a better society. Obtaining the digital signature of the trustees:

Creation of trust to create a public charitable trust, there must be a settlor of trust or someone at whose instance the trust is created along with. Sec 8 company (as per companies act 2013) (previously it was sec 25 company as per companies act 1956) formation and selection. The process of registering a charitable trust in india generally involves the following steps: