Who Else Wants Tips About How To Get A Secured Personal Loan

Secured loans are typically available through traditional banks and credit unions, as well as online lenders, auto dealerships and mortgage lenders.

How to get a secured personal loan. A secured personal loan may: You may find a secured personal loan rate as low as 2.25%. Follow these five steps to get a secured loan:

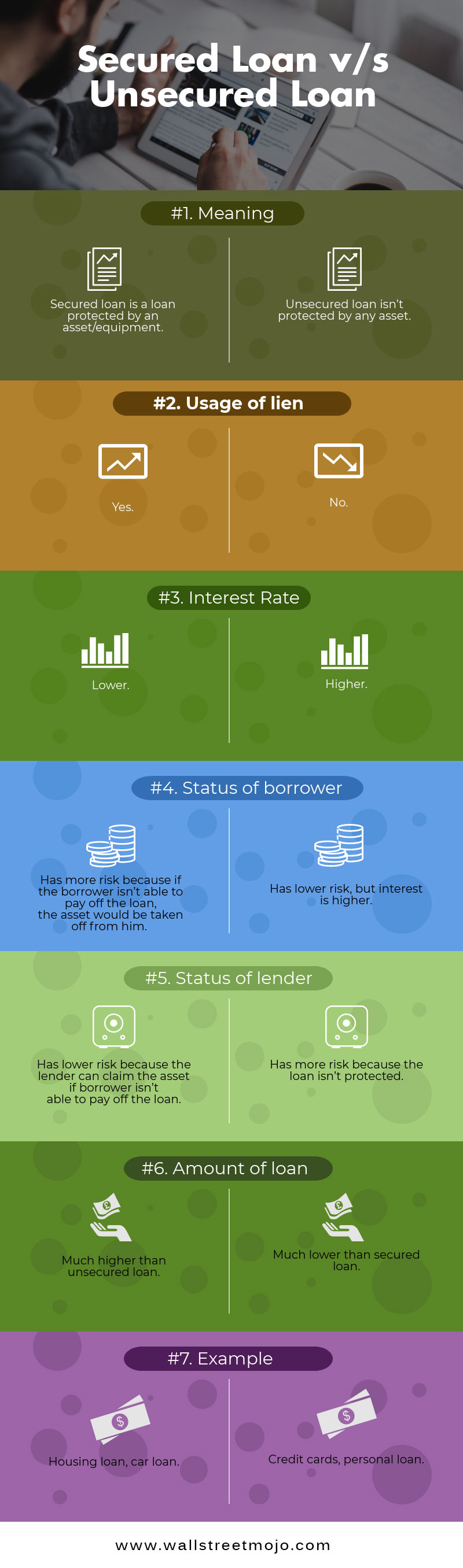

The value of your collateral. These loans typically charge higher interest rates to. Calculate what your monthly payment would look like for each loan (if it wasn’t already provided).

A secured personal loan requires assets that are equal to or exceed the. Best small secured loans what to. But there are also two types of secured loans you can use when you need to buy a specific.

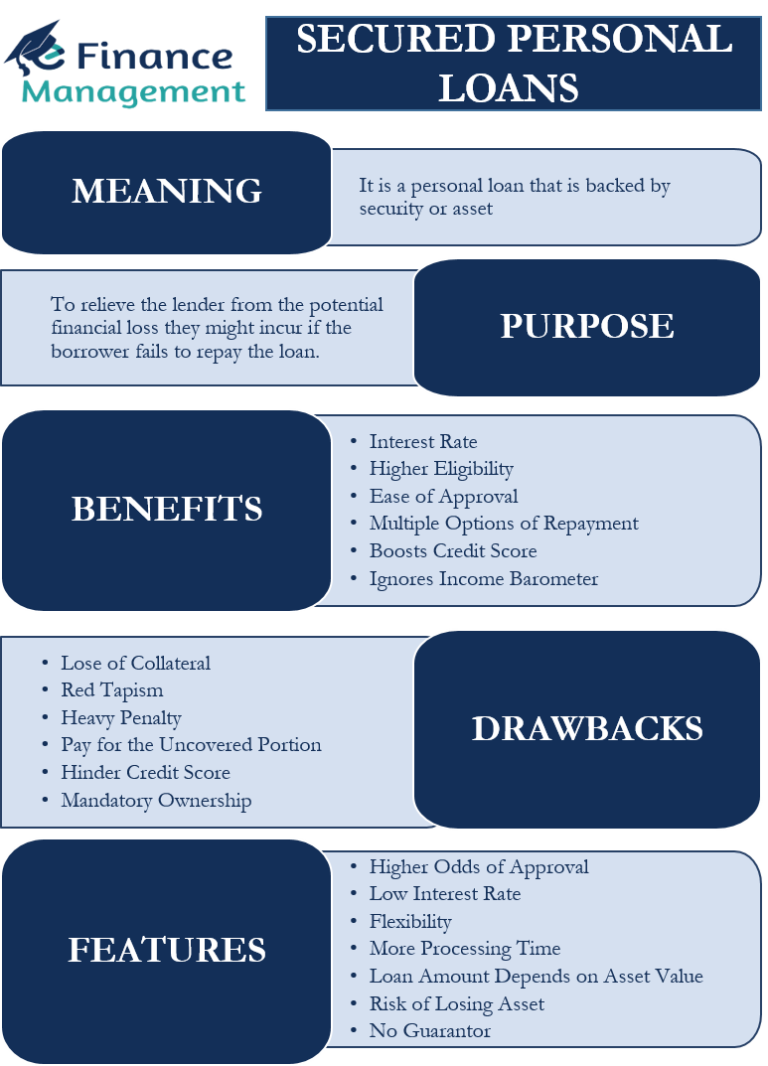

Secured personal loans allow you to borrow money for any purpose. Nerdy takeaways secured loans require you to pledge collateral in order to borrow money. Secured personal loans let you borrow money against the value of an asset like a car or savings.

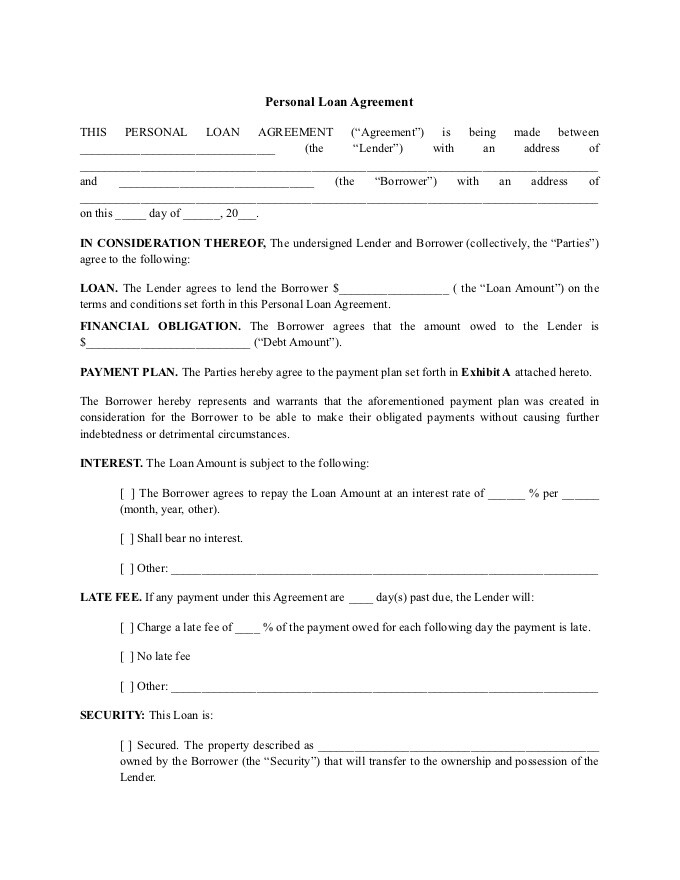

Jessica walrack updated february 24, 2024 fact checked by lars peterson we independently evaluate all recommended products and services. Personal loans can be secured or unsecured. 4 rows the short version.

Key takeaways a secured loan requires you to pledge collateral — something of value like a savings account or car. From loans that don’t require a credit check to those secured by collateral, understanding the differences between these five options will help you make the best. Use your car as security by using your current car or one you’re planning to buy as security, your rate could be.

If you click on links. You can apply for secured personal loans of $1,500 to $20,000 online or at a branch, and collateral can include cars, recreational vehicles (rvs), boats, motorcycles. This can help you narrow down.

In a nutshell. Secured loans are typically available through traditional banks and credit unions, as well as online lenders, auto dealerships and mortgage lenders. Pros and cons of a secured personal loan.

Check your credit score.before applying for any loan, check your credit score using a free online service or your credit card. Because they are less of a risk for the lender, secured loans have lower interest rates. Secured personal loans are less risky for the lender, who can take possession of your collateral if you.

In contrast to a secured loan, an unsecured personal loan doesn’t require collateral to get approved. Lenders review your credit, finances and the value of the collateral to. Common secured loans include auto loans, title loans, home equity loans, and pawn shop.

:max_bytes(150000):strip_icc()/what-difference-between-secured-and-unsecured-debts.asp-final-c2040f78625b44d98372ea024fa51697.png)