Out Of This World Info About How To Apply For A Federal Identification Number

Start your business.

How to apply for a federal identification number. An ein also comes in handy to separate your business and personal finances, open a business bank account or apply for a business. It’s also worth remembering that applying for a tax id number is free. If your itin is only being used on information returns for reporting purposes, you don't need to renew your itin at this time.

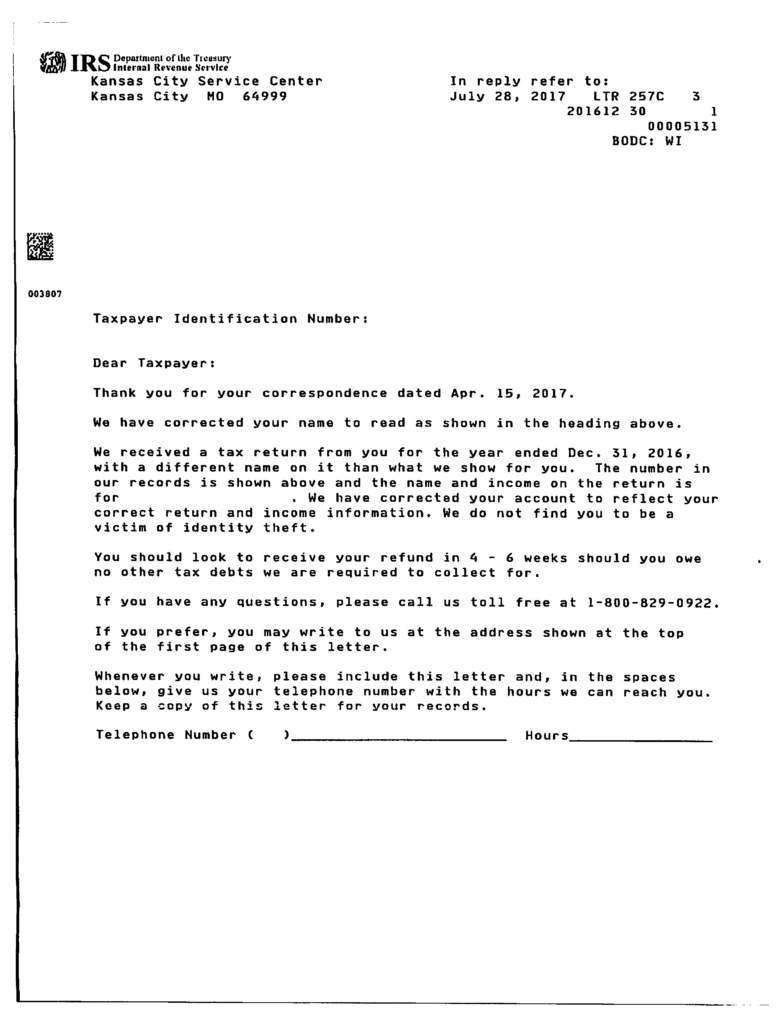

The site will validate your information and issue the ein immediately. The internal revenue service (irs) requires political committees to obtain a tax id number, formally referred to as an employer identification number (ein). How do i apply for a federal tax id (ein) number?

How to get a tax id number in 3 steps. But who is not eligible for an ssn. All forms of businesses can apply for and be issued eins, including:

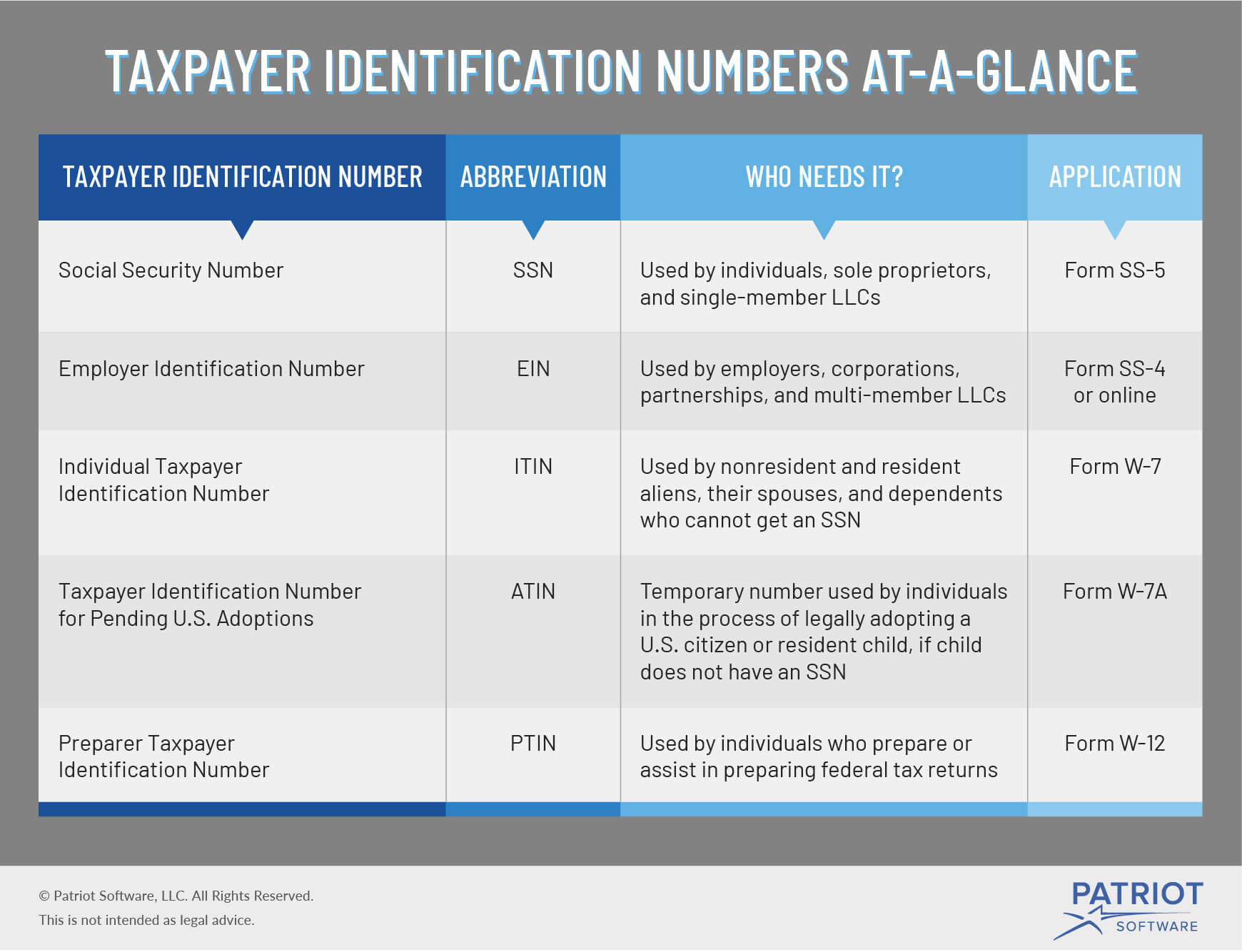

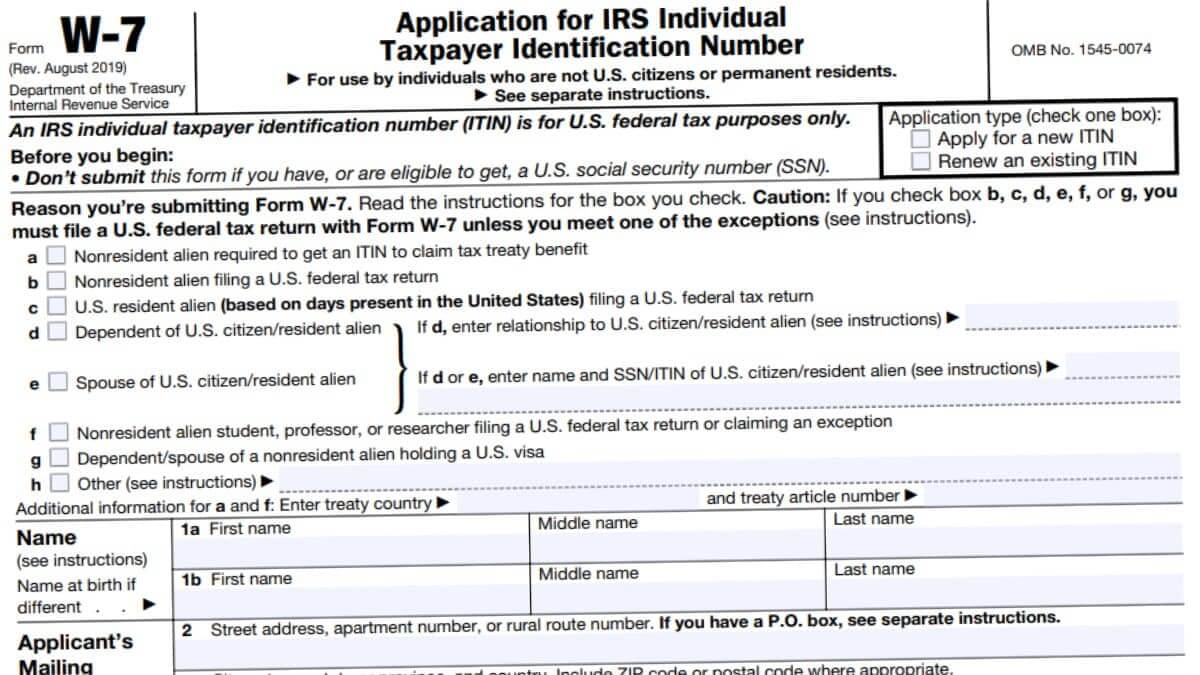

The irs will issue an individual taxpayer identification number (itin) to an individual who’s required to file a federal tax return in the u.s. It's free to apply for an ein, and you. An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity.

Frequently asked questions (faqs) every individual person gets a tax id number when they are born, known as your social security number. This step is crucial as it ensures the irs can properly associate your new tax id with the correct entity or individual. You may apply for an ein online if your principal business is located in the united states or u.s.

See personal finance insider's picks for the best tax. Determine if you need an employer identification number (ein) by answering these questions. To use the online application, the following must be true:

You may apply for an ein in various ways, and now you may apply online. How to get an itin: Your employer identification number (ein) is your federal tax id.

Your principal business, office, or legal residence is in the u.s. Start » startup. If you’ve been asked to pay to apply, you’re on the wrong site!

A tax id ensures your ability to legally pay your employees (and get up to $26,000 back per employee with the erc tax credit ), file for your annual tax return, apply for business licenses, and participate in business banking. You will need an ein if you answer yes to any of the following questions. The data book tells us that people lost $10 billion to scams in 2023.

The easiest and quickest way to get one is to apply online: Business entities must apply for an ein by phone, online, fax, or mail before they can begin operations. The preferred and quickest way to obtain your committee's ein is via the irs's website.